Fed report finds 75% of $800 billion Paycheck Protection Can Be Fun For Everyone

Apply for the SBA Paycheck Protection Program - PPP Loan for Beginners

Conclusions: An Important but Imperfect Policy The PPP was a large and really prompt fiscal-policy intervention, conserving about 3 million tasks at its peak in the 2nd quarter of 2020 and dispersing $800 billion well within 2 years of the start of the COVID-19 crisis. But it was inadequately targeted, as practically three-quarters of its advantages went to unintentional recipients, consisting of entrepreneur, lenders and providers, rather than to employees.

See U.S. Small Company Administration, "Forgiveness Platform Loan Provider Submission Metrics (PDF)," with data as of June 20, 2022. click to investigate of Congressional Research Study Service, "COVID-19 Relief Assistance to Small Organizations: Problems and Policy Options," Oct. 1, 2021. See Douglas W. Elmendorf and Jason Furman, "If, When, How: A Guide on Fiscal Stimulus," Technique Paper of the Hamilton Task, Brookings Organization, January 2008.

Crane, Mita Goldar, Byron Lutz, Joshua Montes, William B. Peterman, David Ratner, Daniel Villar and Ahu Yildirmaz, "The $800 Billion Paycheck Defense Program: Where Did the cash Go and Why Did It Go There?" Journal of Economic Viewpoints, Spring 2022, Vol. 36, No. 2, pp. 55-80. See Autor et al., 2022, pp.

The smart Trick of Paycheck Protection Program Liquidity Facility (PPPLF) That Nobody is Talking About

See "Rubio Details Historic Success of the Income Protection Program," a Dec. 10, 2020, press release from the senator's office.

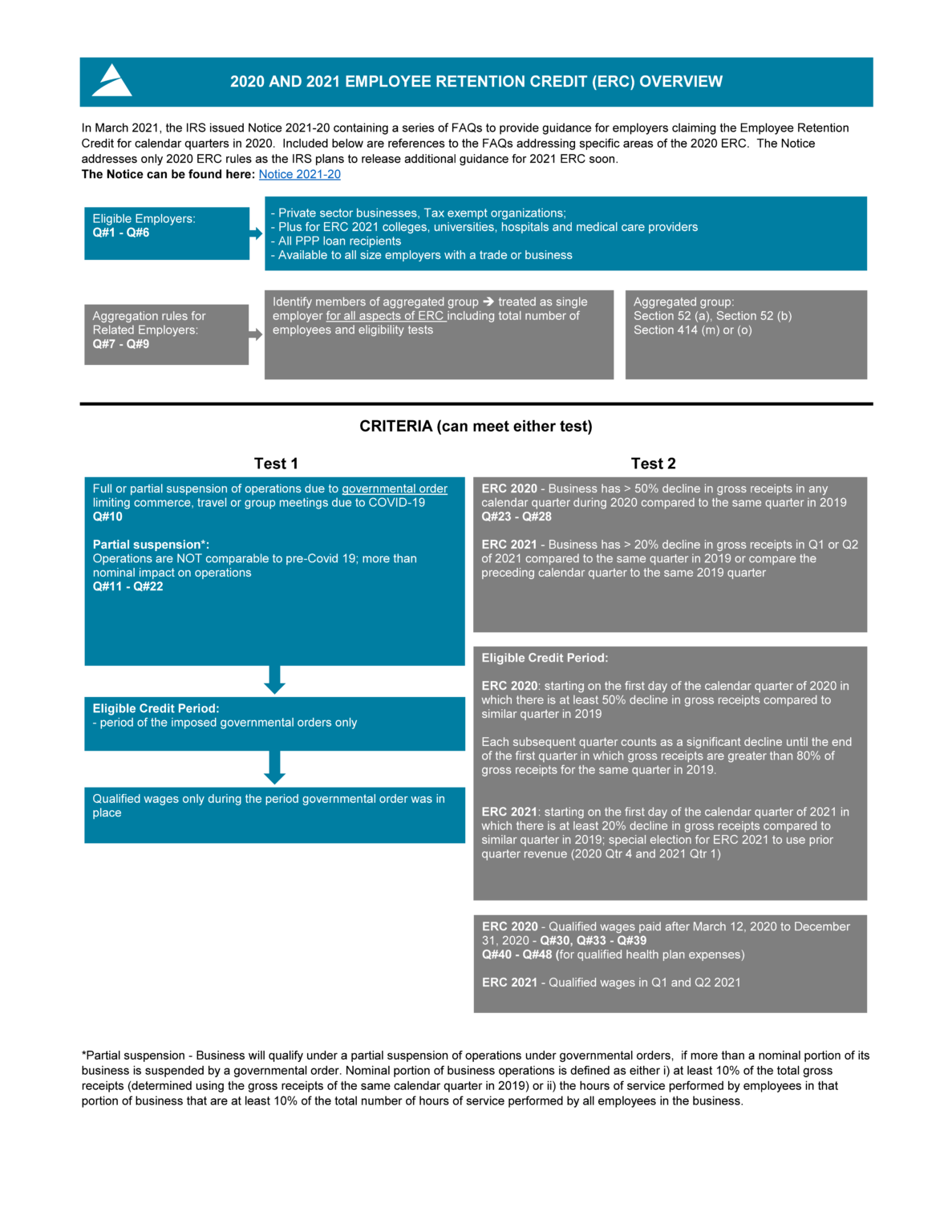

As part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), a $484 billion help plan signed on April 24, 2020 and the Income Defense Flexibility Act indication June 5, 2020the Paycheck Defense Program (PPP) supplied $659 billion of loan funds to support small companies, not-for-profit companies, and other eligible entities affected by COVID-19.

Please see below for overview and training files with information on how to use.

The Of Paycheck Protection Program - Wikipedia

The U.S. Small Service Administration (SBA) published new guidance Wednesday developed to simplify and accelerate the forgiveness process for organizations and not-for-profits with Income Security Program (PPP) loans of $150,000 or less. The SBA also revealed that it will launch a new application portal Aug. 4, allowing borrowers to look for forgiveness directly with the firm instead of having to go through their lender.

UNDER MAINTENANCE